Eic For 2024 Table

Eic For 2024 Table. You as a dependent or qualifying child. Earned income tax credit calculator for 2024 & 2023;

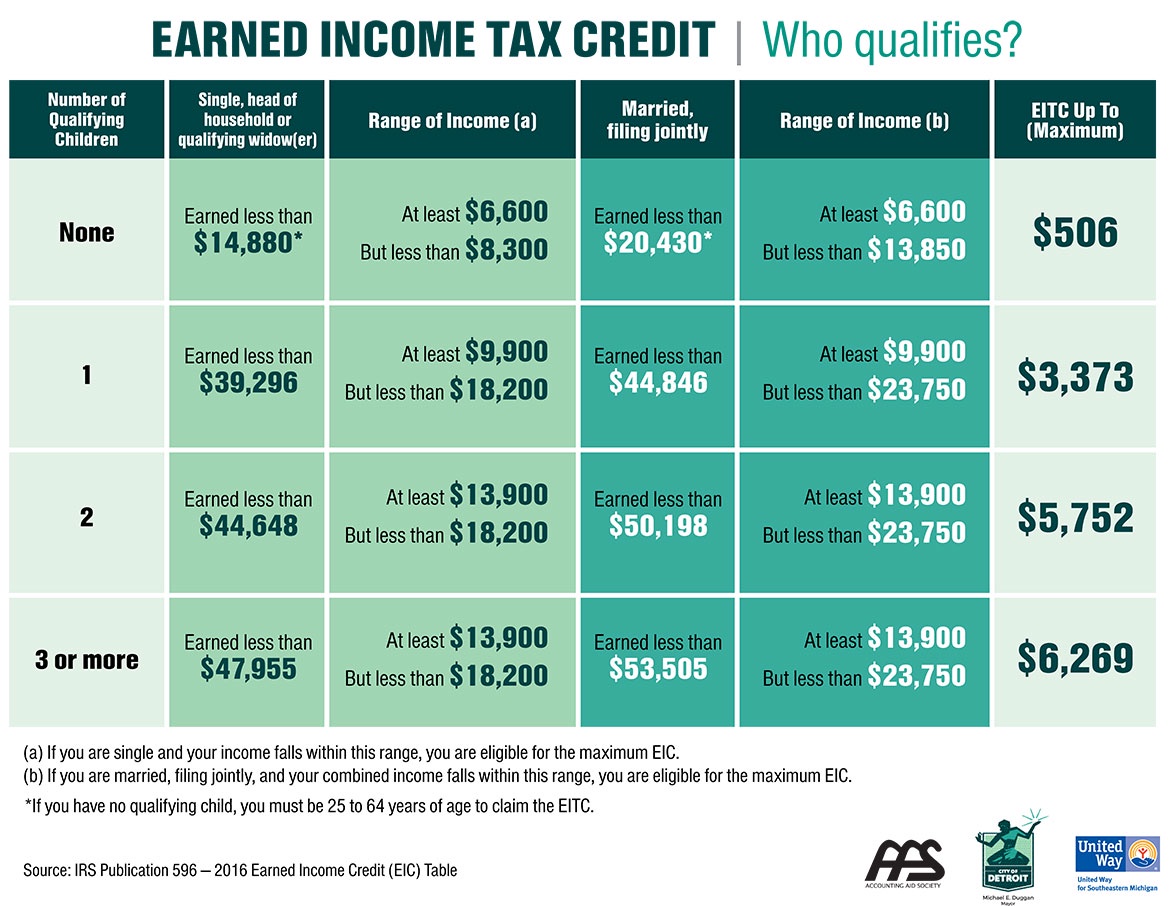

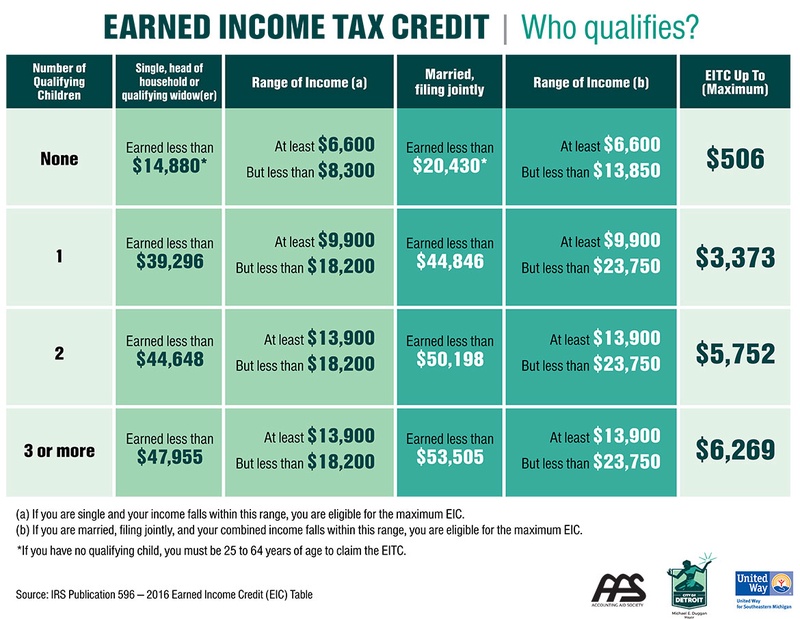

Use these table organized by tax year to find the maximum amount of eitc you may be eligible for based on your: Earned income credit (eic) table 2024 & 2023 or eitc tax table for 2023 & 2024.

Eic For 2024 Table Images References :

Source: techplanet.today

Source: techplanet.today

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Am i eligible for the eitc in 2024?

Source: techplanet.today

Source: techplanet.today

The Ultimate Guide to Help You Calculate the Earned Credit EIC, It helps determine the amount of credit taxpayers are eligible for.

Source: ar.inspiredpencil.com

Source: ar.inspiredpencil.com

2022 Eic Tax Table Chart, If you earned less than $66,819 (if married filing jointly) or $59,899 (if filing as single, qualifying surviving spouse or head of household) in tax year 2024, you may qualify for the earned.

Source: www.unclefed.com

Source: www.unclefed.com

Earned Credit (EIC) Table (cont.), Is the earned income tax credit refundable?

Source: heidibmirella.pages.dev

Source: heidibmirella.pages.dev

Eic 2024 Tax Table Sela Wynnie, Earned income tax credit calculator for 2024 & 2023;

Source: turtaras.blogspot.com

Source: turtaras.blogspot.com

Astounding Gallery Of Eic Tax Table Concept Turtaras, Tax year 2023 income limits and range of eitc number of qualifying children for single/head of household or qualifying surviving spouse, or married filing separately*, income must be.

Source: tamiqalverta.pages.dev

Source: tamiqalverta.pages.dev

Irs Eitc Table 2024 Greer Agnesse, The eic table plays a key role in this process.

Source: www.zrivo.com

Source: www.zrivo.com

EIC Table 2024 2025, To qualify for the credit, you must have earned income and adjusted gross income that falls within the income limits in the eic table 2024.

Source: martitawdarda.pages.dev

Source: martitawdarda.pages.dev

Montgomery County Eic Checks 2024 Jolie Madelyn, Tax year 2023 income limits and range of eitc number of qualifying children for single/head of household or qualifying surviving spouse, or married filing separately*, income must be.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

EIC Table 2023, 2024 Internal Revenue Code Simplified, See the instructions for line 16 to see if you must use the tax table below to figure your tax.

Posted in 2024